It’s a Numbers Game

“Life is a series of nested games, and all of us are playing many games simultaneously.”

Business is a numbers game

The execution of business, the operations of business, the getting-the-job-1done part of business … is a numbers game.

What do I mean by that?

If you’ve been following these series of articles, you’ll know that I mainly write about The Mechanics of Business. Of viewing business as a system. Of discovering and understanding inter-related mechanisms that structure the business system.

And that’s all good as a top high-level introduction to show you, the Newbie Entrepreneur, how you need to begin understanding the future living organism of the business which you are creating.

And yes, you need a great distinguishing product concept (the art part). And yes you need to identify the market niche you’ll be mining for customers (the intuitive part). But compared with taking your business to the goal line, those are The Easy Parts of starting a business! Lots of innovators and intuitors have gotten that far.

Getting across the goal line is a numbers game.2

We’ve already encountered the objective of business in the Basic Core Concept of Business: “Buy Low; Sell High; Invest the surplus.” So we understand what is the goal of the business game.

And the rules? We’ve talked about the rules of business as well and how expectations affect professional conduct. But here the “rules” represent the encompassing framework of that basic formula for business. And that means numbers … arithmetic. Constantly knowing and calculating the score. But I’m not talking about driving the business by numbers, as say an accountant might do.

I’m talking about being the captain of your ship and navigating the watery wilderness you are crossing. That means knowing the key numbers for your business: top-to-bottom.

The Vocabulary, The Language

What is Cost? What is Profit? What is Depreciation? These terms, these concepts, which are embedded in the language of Accounting are NOT esoteric terms for you to ignore or to delegate to others or simply dismiss as (sniff) bookkeeping. These are the sextants, the rudders, the sails, the hull of the vessel you are commanding.

You would never ride on a commercial jet if the pilot wasn’t trained in all the switches, flaps, and aerodynamic operations of flying, would you?

So why do you attempt to steer the ship of business without some knowledge of the language of commanding the business?

Knowing these terms means you have a working knowledge of “buy low, sell high, invest the difference” because you can answer the basic questions about: what are your actual product costs? How much return can you generate from your given capital starting point? What numbers tell you your actual profit (thus telling you if the ship is making headway or falling behind)?

This topic is coming about because yesterday I was speaking with an entrepreneur who thought he was making a profit because during his trial phase, he was selling his bags of rice for more than the rice itself cost. Now as he faces the need for basic starting capital, he needs to know much more about what it will take to make this business a healthy, successful, on-going system.

So let’s get into some of the aspects we have to consider when trying to answer basic questions about using somebody else’s money to fund a business. Even if that “somebody else” is self, family, or friends. Because it should not, does not, matter whose money is being used. A healthy vibrant business will be able to pay its bills, offer a reasonable return on use of capital (interest, dividends), provide for the needs of the people working in that business (salaries, security, career development), and give something of benefit to the community and society within which it has the privilege to operate.

Basic Questions for captains to answer

Capital: Will X capital fuel the basic functioning of the business machine; ie, an initial level of operations; be self-sustaining (at an initial basic level)? Will it be sufficient to purchase the equipment and cover initial start-up operations?

Operations: Will those operations generate enough excess to

Provide sufficient cash flow so that the business is not starved of operating funds?

Cover the minimal operating costs?

Pay basic minimal salaries to the workers?

Accrue depreciation for capital equipment?

Pay rent on the usage of that capital (interest)?

Fund an increase in capital for future growth? and/or pay back the initial capital invested?

Meet all government obligations (taxes, fees, regulations)?

Accrue funds for unknown, unexpected reversals/problems?

Expenses: What are the major expense areas of product and operations?

Sales: How many units per time period (weekly/monthly) need to be sold to be self-sustaining?

Production: Can manufacturing produce that many units in that time period?

Payment: How long after you have delivered the product will you have cash in hand?

Product Cost: What are the true costs on a per unit basis of whatever it is that you are selling?

Profit: How and when will you know when you are profitable?

ROA or Gross Profitability Ratio: How effective is your capital usage? How does that compare with other standards for the business field you have entered?

Practicality: How many units do you need to sell to reach your financial goals? Is that even physically possible to do? Is your market large enough to support those numbers?

Stages of calculations

There are five stages of calculations to consider. Each stage depends upon where you are at in the planning, preparing, or operating cycle for your business.

Quick draft calculations

Done quickly (1-2 hours), pen & paper, guesstimating reasonable numbers to major categories. Used to quickly scope out feasibility of the business. Yields ‘ballpark’ numbers (+/- 20%); Stop? Go?First Draft calculations

Reworks the draft (1-2 days), this time in a spreadsheet on the computer, refining estimates and basic assumptions. Tries to get within +/- 10%. Stop? Go?Business Plan calculations

This stage is for researching accurate numbers, refining the spreadsheet (1-3 weeks), and getting the plan to a working model suitable for scrutiny by outsiders as part of the business plan.On-going operational metrics (daily/weekly/monthly/quarterly)

Key Realtime metrics to be monitored for running the business to check progress against planned strategy.Accounting reports

Complete detailed accounting at the end of accounting periods.

Example

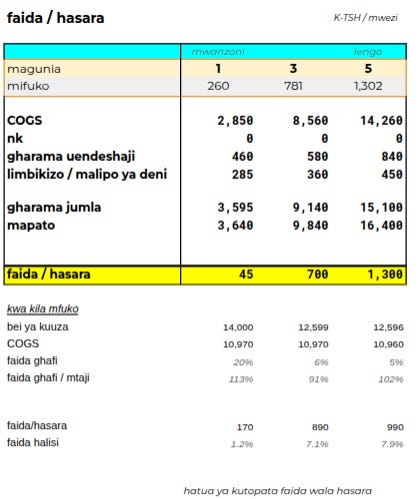

While assisting a friend in Stage 2: First Draft Calculations, I prepared a spreadsheet for a product which he plans to purchase wholesale and repackage into 5-kg retail units.

It takes a while to wrap one’s head around a particular business model and get everything into the spreadsheet to aid in what-if thinking and modeling. Each business will be different and each business will yield a different structure in the spreadsheet.

Because this business is focused on the repacked product, and will live or die based on that, I felt it important to end up with a financial model that focused on the per unit product and its related metrics.

In the spreadsheet, I created the following tabs in the following order of development.

Product: captures all the parameters relating to the product, re-packaging, and costs. AKA: COGS (Cost of Goods Sold).

Operations: captures all of the non-COGS operational expenses. These would be rent, salaries, advertising, etc.

Capital: this captures the capital infusions for purchasing repackaging equipment, raw materials, government tax license, etc.

Personal: this is for his personal minimal needs budget for living expenses (which is then pulled into the Operations tab).

Accrual, Depreciation, Loan Repayment: This tab is not quite standard: It kind of borders on a Cash Flow Issue, kind of future needs issue, and kind of normal accounting practice. But I wanted it separate for an instructional and managerial focus. It highlights how and why he’ll be pulling off gross margin and accruing it in a bank account; and the intervals at which it will be needed. It is key for making sure that the business is healthy and self-sustaining.

P&L (Profit & Loss) model: This is the objective of our calculations (screenshot below). It takes all the information we’ve gathered, and relates it to COGS, Gross Sales, Operating Expense, Accrual/Depreciation, and per-unit costs and profitability. It is used to answer many of the questions I raised in section 2.

Dr Orion Taraban, The Value of Relationships, 2025.

“A game is anything with rules and a goal.” ibid